Loyalty Program KPI’s: Margin Lift

A key measure of loyalty program performance is positive impact on Profit Margin. In order create a Margin Lift, the loyalty program needs to drive a change in behavior, and this is a notoriously tricky thing to measure. Comparing members to non-members reflects well on the Loyalty program, but it isn’t really a fair comparison because better customers are usually the ones who join the program (chicken, meet egg). And because loyalty programs are generally part of the overall brand proposition, it is difficult to have a control group for whom the program is not available – the exception to this is when a program is first launched, when there may be limited testing opportunities.

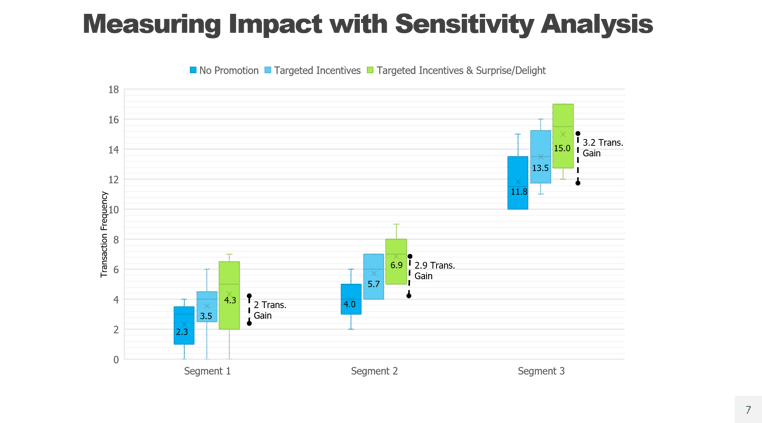

The LoyaltyLevers approach to measuring this Loyalty KPI is akin to the popular media mix analysis approach that evaluates changes in performance based on variability in media spending. The data is used to develop a model that allows the marketer to predict sales based on spending. A similar approach is used to evaluate varying levels of loyalty promotions and the resulting changes in behavior to understand the sensitivities. This data can certainly be used to understand the impact of the promotions, but also to estimate the baseline impact of the program itself.

Three Steps to Measuring the Margin Lift Loyalty KPI

There are three overarching steps to measuring the margin lift loyalty KPI.

- Use present day margin as a starting point: the Finance team should be able provide a straight-forward answer to this question, fully loading in all program costs, and making no assumption about incremental impact (yet).

- Break margin down by segment and calculate it over the last three years: Looking at an overall average for a program can mask important trends. If you have a behavioral segmentation of 6-10 members groups, use that. If you don’t, a segmentation should go on the priority list, but a rudimentary RFM type of segmentation will suffice.

For example, margin level for the ultra-loyalists will be quite different from that for brand new members. At this point you’ll already start to see some insights. A rapid growth of the high margin segments over the last 3 years is quite telling. - Evaluate changes in margin for various program tactics: The ability to do this retroactively is likely limited, unless you have a very rich promotional strategy. But even in the absence of statistical models, you’ll begin to get a sense of the magnitude of the program impact. If you saw a 25% increase in volume based on a double points promotion, how much would you have lost with no points program at all? More likely, you’ll need to establish a robust test and learn agenda for the coming year, which will not only amplify the impact that the program is having but provide a much stronger sense of what spend patterns would have been with no program at all.

Six Levers of Loyalty Program Performance

There are six levers to move loyalty program performance, and much like media mix analysis, the total calculation of gross margin is enabled by testing and reading the impact of each one.

- Transactions per Member: Many loyalty programs are designed as frequency builders. For example, number of “one and done” members (frequency of 1) is often an issue among newer customer segments. Or implementing various tactics to drive an extra visit can be very fruitful. By building test plans over time you’ll be able to measure the impact of various strategies. Institutionalizing a high impact campaign provides a known margin lift. It is critical to look at these results at a segment level, as differing segment mixes can have a profound impact on results.

- Transaction Size: In particular for lower frequency purchase categories, loyalty programs can be effectively used to increase average ticket through the use of targeted discounts, point bonuses and/or highly relevant communications. Testing these types of programs, and in general optimizing the program to build transaction size will have a large and immediate impact. Variability in these kinds of programs over time will strengthen the model.

- COGS: Steering loyalty members towards higher margin products can also provide an immediate boost to program margin. For example, in the hotel industry there could be an incentive to visit a nearby hotel when the traveler’s primary destination will be filling up regardless. Within the grocery vertical, promoting house brands that have a much higher margin is extremely common and successful, and may have lasting impact far beyond the promotion by establishing a habit with the member. As in all the other cases, rigorous test design is needed in order to establish the relationships.

- Active Members: Number of members is perhaps the easiest to measure. Once you have a sense of the margin lift within a segment, acquiring new customers has an immediate and positive impact. The impact of churn can be disastrous, and programs designed to improve retention rates will have a long-lasting impact. Programs designed to move lower value customers to higher value segments (for example six months of Elite status) can have a beneficial impact.

- Rewards Costs & Liabilities: Many times, cost reduction is where executives turn first in order to boost program financials. Unfortunately, members often notice the impact, so these types of steps need to be taken with great care and tested just like any other Lever. There are often low/no impact ways to improve reward economics, or to reduce liabilities – for example by promoting burn at an opportune time

- Program Costs: Driving efficiencies out of vendors and digital transformation can provide an extra boost to overall margin, though usually small in the scheme of things.

Loyalty KPI: Margin Lift

While far from simple, this approach to estimating Margin Lift provides arguably the most accurate view of loyalty program performance on the Behavioral Lever. Perhaps equally important, it serves as a platform to enlist stakeholders into the ongoing test and learn process will have multiple benefits by encouraging an environment of continuous improvement. Substantive ongoing test and learn scenarios must be developed to continue to find winning strategies to not only measure but increase the program impact.

This mindset can also open-up new opportunities across the organization for the Loyalty Program to have a transformative impact. For example, the way that companies like Starbucks and Chipotle have used the program as the means to improve and streamline the customer experience. With this kind of mindset, the loyalty team can be ambitious and creative in their thinking. History has proven that innovators win in the loyalty space.

Loyalty Consulting Services

LoyaltyLevers supports clients with the following kinds of Loyalty Consulting Services:

- Data and Integration Strategies

- Custom Analytics and Statistical Modeling

- Loyalty KPI Development

- Loyalty Reporting and Dashboard Development

- Loyalty Consulting