Software Options for Small Business Customer Loyalty Programs

POS Systems like Square, Clover and Toast have revolutionized Customer Loyalty Programs for Small Businesses. Each...

Category titans Sephora and Ulta both have powerful loyalty programs, in fact according to Newsweek’s “America’s Best Loyalty Programs 2021” survey they are at parity with each receiving a 7.6 rating from consumers . This article provides a thorough review of each program, digging in to how they are applying loyalty design and best practices. Both programs are strong, with Beauty Insider delivering over 80% of Sephora’s revenue and Ultamate Rewards delivering over 90% for Ulta. However, they take dramatically different approaches, and the contrast provides insight to practitioners who are considering their program design and how it plays to their brand’s strengths.

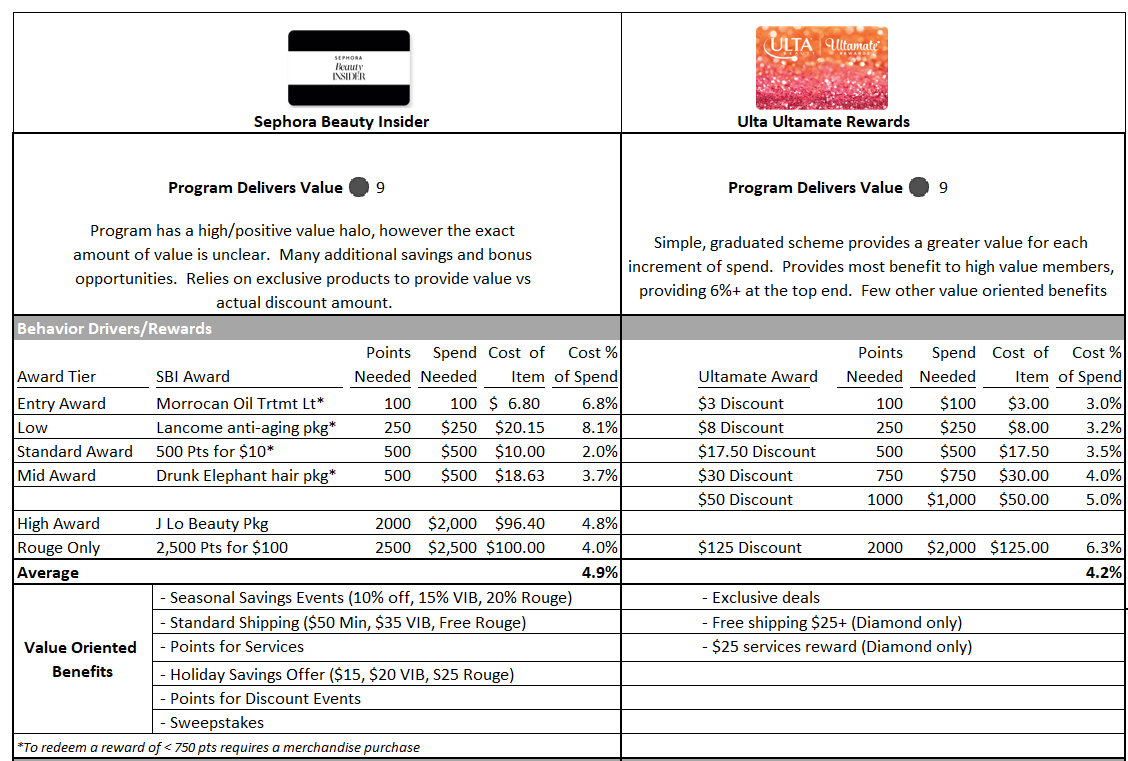

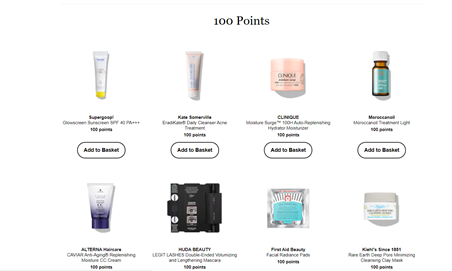

Both programs deliver significant value for their members and score 9/10, though using different strategies. Analyzing the core reward schedule shows some of the most significant variations:

Looking beyond the rewards schedule, Sephora layers on many additional savings and bonus opportunities including seasonal savings events, holiday savings certificates, and doubling points during savings events for even more value. All of these work together to reward the most engaged members who take the time to track the offers available.

As more of a value-oriented brand, Ulta already provides lower price points, and adds to that with exclusive deals for members.

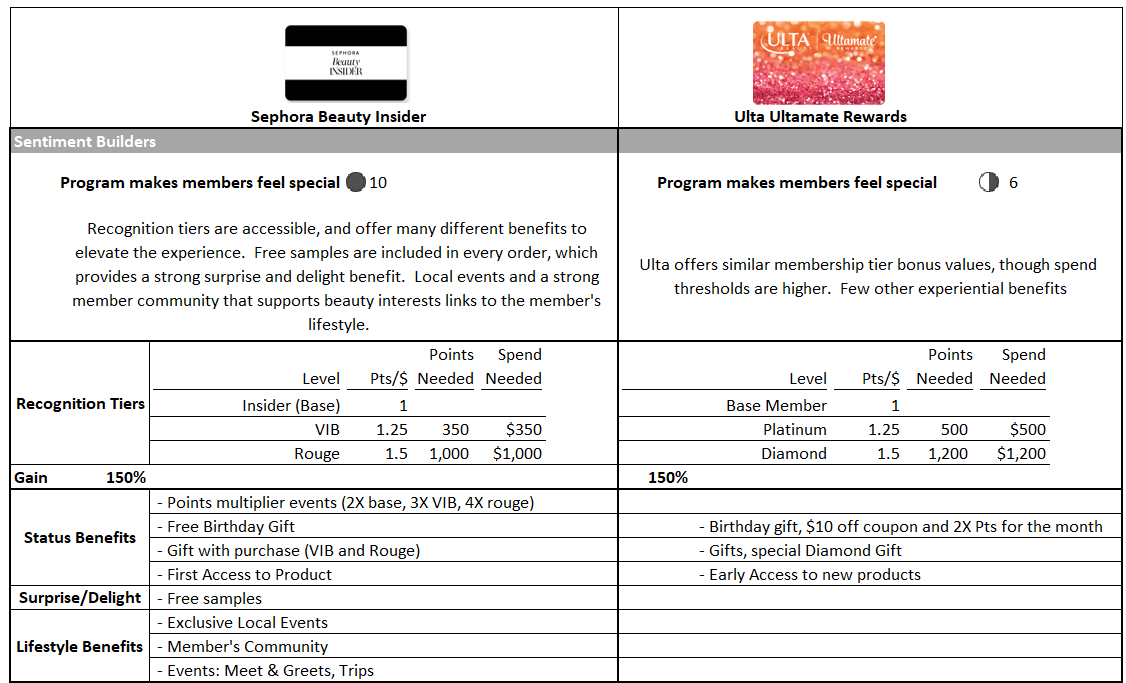

Sephora wins hands down in Sentiment Builders, taking many steps to build emotional loyalty and make their members feel special. Sephora’s free sample program provides a rich benefit that creates a connection to the brand. They also do a great job of supporting category enthusiasts with their Beauty Insider member community and events at the local stores.

While Ulta appears to have matched the basic tier bonus structure, they don’t deliver many benefits in this area – perhaps due to operational constraints.

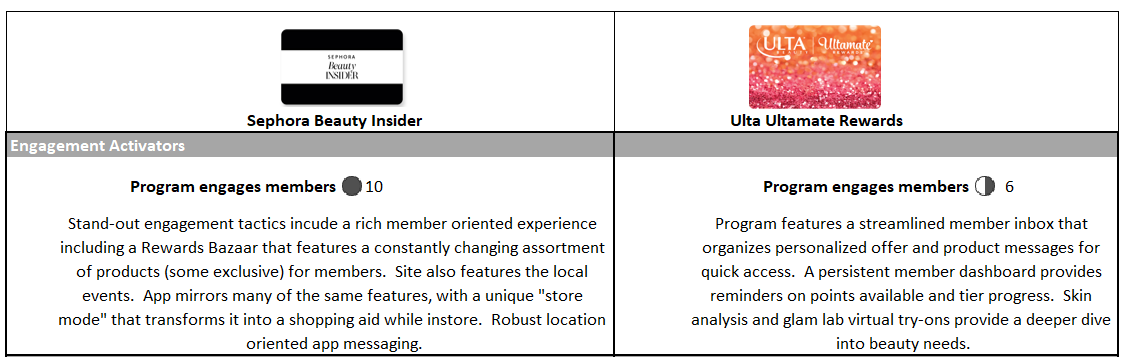

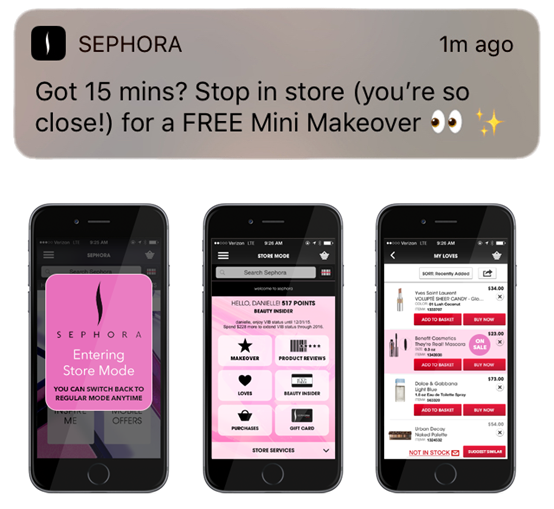

Ulta keeps it simple, with a well-organized member message center that provides quick access to the offers and personalized messages that each member receives. Meanwhile, Sephora does a better job in terms of engaging their members by utilizing innovative strategies on several fronts.

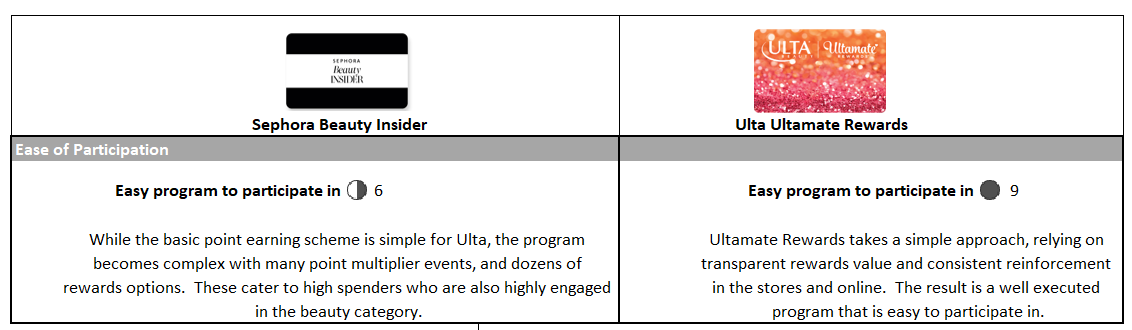

Loyalty Program Examples: Ease of Participation

It is important to remember how overloaded consumers are with marketing messages overall, and loyalty program memberships in particular. They are active in less than half of those they belong to, and often fail to remember how they work. As a result, a program that looks incredible on paper might not be appreciated by the majority of members.

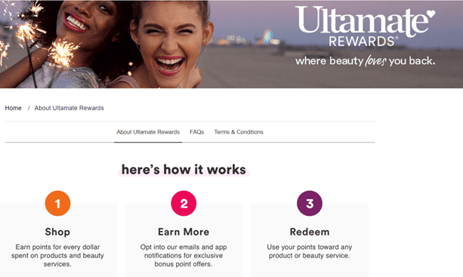

While Sephora offers members a lot with their multi-layered program approach, Ulta wins here, opting for a simple, transparent program that delivers strong value to members. As a result over 90% of Ulta’s revenue comes from this program.

Ulta’s no-nonsense approach is reflected through-out the member experience starting with the straight-forward 1-2-3 program overview provided to members.

Sephora is consistently recognized for their innovative, cutting edge loyalty program design that is in perfect sync with their brand. Sephora could use personalization more in order to simplify the experience and focus each member more on what truly matters to them – as it is many of the benefits likely go unnoticed.

Ulta’s more straight-forward approach fits with their brand, but the program needs to do more to build an emotional connection and true loyalty among their customers. Rather than half heartedly mimicking Sephora as Ulta has done with their membership tiers and SuperGreat community, they would be well served to explore other surprise/delight tactics and/or convenience oriented benefits that will build stronger member relationships.

POS Systems like Square, Clover and Toast have revolutionized Customer Loyalty Programs for Small Businesses. Each...

Over the last few years, I’ve seen client interest grow dramatically in revamping their customer loyalty program...

Comments